![how-to-improve-cibil-score-infographic-plaza]()

![How to Improve your Credit Score how-to-improve-cibil-score-infographic-plaza-thumb]()

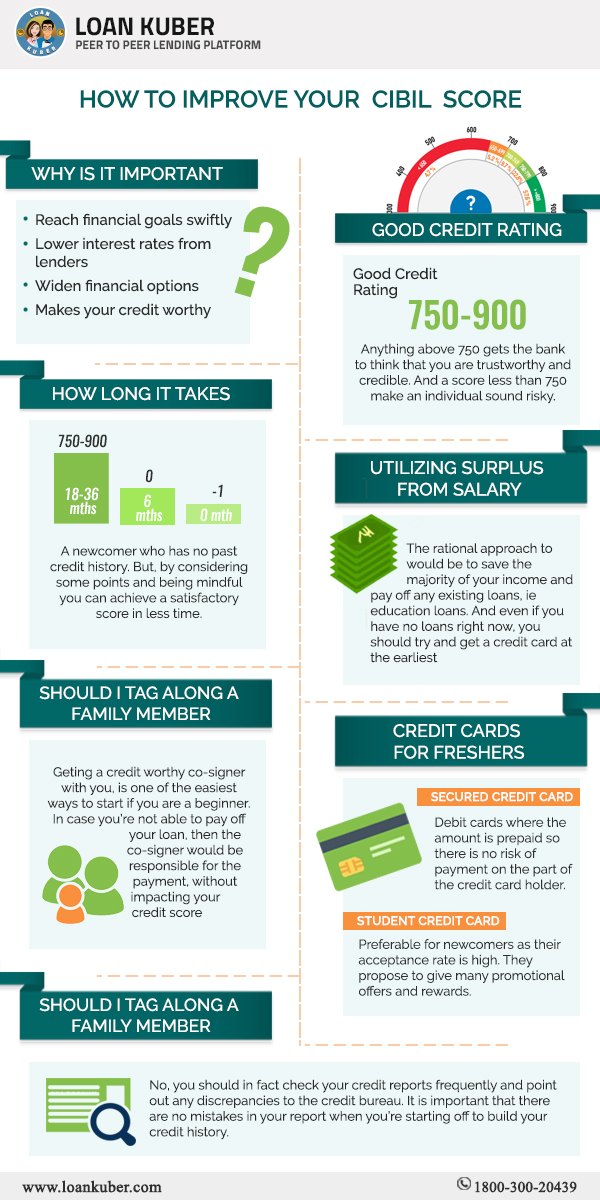

A good credit rating widens your financing options and you could avail loans effortlessly. This will help you to reach your financial goal

swiftly as the hindrances are getting eliminated. The lenders seeing your history could be convinced to offer you better loans with low interest rates.

Why is it important to improve your CIBIL score? Reach financial goals swiftly and widen financial options. It is considered that anything above 750 gets the bank to think that you are trustworthy and credible. And a score less than 750 make an individual sound risky.

The rational approach to would save the majority of your income and pay off any existing loans, ie education loans. And even if you have no loans right now, you should try and get a credit card at the earliest.

![How to Improve your Credit Score how-to-improve-cibil-score-infographic-plaza]()

Source:

https://www.loankuber.com/content/cibil-score/credit-score-suggestions-to-freshers/

A good credit rating widens your financing options and you could avail loans effortlessly. This will help you to reach your financial goal

swiftly as the hindrances are getting eliminated. The lenders seeing your history could be convinced to offer you better loans with low interest rates.

Why is it important to improve your CIBIL score? Reach financial goals swiftly and widen financial options. It is considered that anything above 750 gets the bank to think that you are trustworthy and credible. And a score less than 750 make an individual sound risky.

The rational approach to would save the majority of your income and pay off any existing loans, ie education loans. And even if you have no loans right now, you should try and get a credit card at the earliest.

A good credit rating widens your financing options and you could avail loans effortlessly. This will help you to reach your financial goal

swiftly as the hindrances are getting eliminated. The lenders seeing your history could be convinced to offer you better loans with low interest rates.

Why is it important to improve your CIBIL score? Reach financial goals swiftly and widen financial options. It is considered that anything above 750 gets the bank to think that you are trustworthy and credible. And a score less than 750 make an individual sound risky.

The rational approach to would save the majority of your income and pay off any existing loans, ie education loans. And even if you have no loans right now, you should try and get a credit card at the earliest.

Source: https://www.loankuber.com/content/cibil-score/credit-score-suggestions-to-freshers/

Source: https://www.loankuber.com/content/cibil-score/credit-score-suggestions-to-freshers/